blog

News & Updates

Know Your Master Agreements – be prepared for the next crisis

The frameworks of standard documentation for OTC Derivatives, Securities Lending and Repurchase Agreements have been tested by a succession of financial crises since they were widely adopted in the 1990’s. The Asian currency crisis, the Russian debt default, the...

Is your contract analysis tool just a new version of an expensive spreadsheet?

Way back in 2013 I wrote an article in FX-MM magazine (no longer operating) about the ‘false economy of the million dollar spreadsheet’. The article was inspired by the panic that happened across the financial markets in the wake of the financial crisis. Banks...

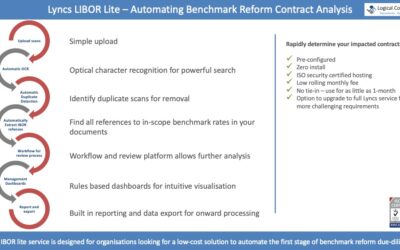

LIBOR-Lite Module Launched – Low Cost Start To Benchmark Reform

Stop talking, start doing! Logical Construct are pleased to launch a new LIBOR module designed for organisations looking for a low-cost solution to automate the first stage of benchmark reform contract analysis. Recent market surveys indicate a large number of...

LIBOR transition: The FCA is thinking about conduct risk – are you?

The LIBOR transition is one of the broader reaching changes to affect the financial services industry in recent years due to the wide range of products it affects. As part of that process many existing financial products offered to clients will need to change, so...

LIBOR Module

While uncertainty still remains about what the migration path from LIBOR, EURIBOR and other rates affected by the reform really is, there is no doubt that change is inevitable. The one part that is certain therefore, is being able to identify which of your contracts...

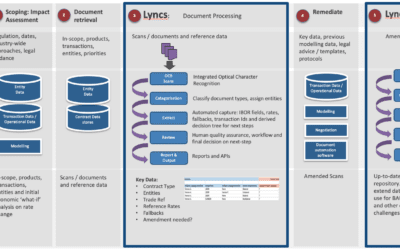

LIBOR Benchmark Reform and Regulation in Lyncs

Document remediation projects are not new. Anyone working in Capital Markets in recent years can probably describe the steps involved as they tend to be similar each time. Recent battle scars in the derivatives world include Uncleared Margin...